Drawing on personal experiences, discussion and the current news, it is easy to paint a picture of how the trade has performed over recent years – but what do the official figures say? FIRA’s new statistical digest provides a summary of how the UK furniture industry is performing, distilling data from a wide range of sources to identify the manufacturing, spending and trading trends that have dominated the sector. Furniture News presents an exclusive summary …

Published in December last year, the report covers 2013-16, and includes some estimates for how 2017 will be recorded, and beyond. Drawing on data from Government bodies such as the Office for National Statistics, HM Revenue and Customs, Communities and Local Government, plus the Bank of England, FIRA’s digest provides one of the clearest available pictures of the industry.

Covering areas such as national economic trends, the structure of the UK furniture manufacturing industry and trading relationships with the rest of the world, the report delivers figures across contract, office and domestic subsectors.

Here are the key findings …

NATIONAL ECONOMIC TRENDS

The UK furniture and furnishings sector

The UK furniture and furnishings sector – comprising design, manufacturing, retail and repair – is much larger than many people think. Total manufacturing turnover in 2016 was £11.28b – the largest proportion of which was furniture manufacturing, at £8.35b.

This turnover emanated from 8390 companies employing 118,000 individuals, and reflected a YoY increase of +2.6%.

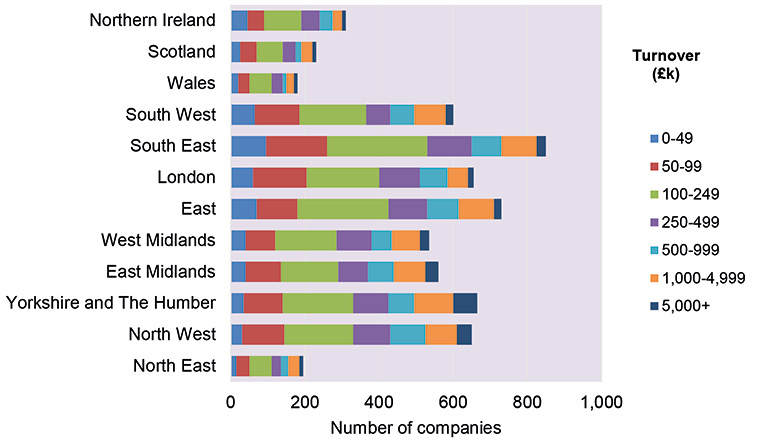

Number of furniture manufacturers in turnover bands by region

The wider sector – including specialist retail, but excluding general retail – comprised almost 50,000 VAT-registered companies, supporting some 327,000 jobs.

“At this stage I don’t envisage massive reductions in the number of jobs within the whole sector in coming years,” says the report’s author Pete Beele. “There could be some losses with increased capital investment in equipment, but counteracting this there is evidence of more companies starting up, plus an increase in turnover – both of which should improve job opportunities.”

Consumer credit and lending

After 2008, total net unsecured lending to individuals in the UK continued to fall, bottoming out at £207.1b in June 2012. Since then it has increased, reaching £292.2b by the end of 2016 (a +10.8% increase on 2015).

Some of this increase in lending was attributable to credit cards (up +5.1% from 2015-16), although lending through other channels was +12.6% greater than at the end of 2015.

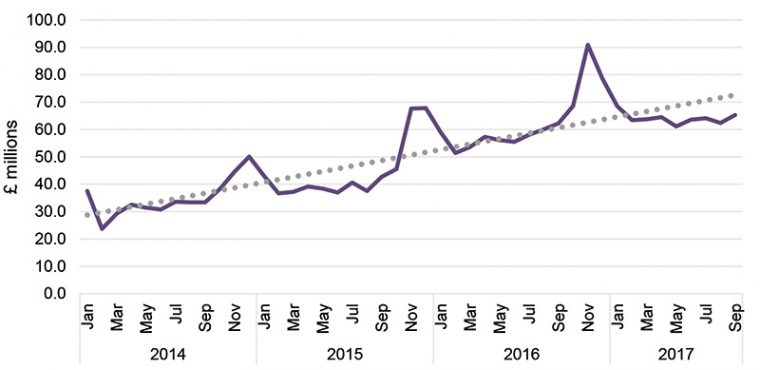

Average weekly internet sales for household goods, 2014-17

Total net unsecured lending continued to rise into 2017, with the latest data (March 2017) indicating an outstanding value of £299b – +10.7% more than the outstanding net lending figure of £270b in March of the previous year.

In addition to the above, there has been a gradual rise in lending secured on dwellings, which increased by +2.7% from the end of 2015 to the end of 2016, when it reached £1321b. Preliminary data for 2017 shows that this figure increased to £1354b by September last year.

House starts and sales

The rate of new UK dwellings starts in 2015/16 fell quite significantly, with 174,520 starts, being only 2380 greater than the previous year (an increase of +1.4%). Provisional data for 2016/17 hints at a YoY rise in dwellings starts for England (+14%), Wales (+2%) and Northern Ireland (+10%). Data was not available for Scotland.

These increases in new homes (no matter how small) will potentially generate domestic furniture sales. However, putting this into context, annual dwellings starts remained well below those recorded in the four years prior to the 2008 financial crisis, when they were typically of the order of 220,000-235,000.

The UK’s new homes trends are mirrored by property transaction statistics where the total number of property transactions above £40,000 only increased by +1.2% from 2015 to 2016.

Whilst the number of non-residential property transactions remained relatively buoyant, the residential market virtually stagnated.Total transactions reached 1.4 million in 2016, and whilst a gradual upward trend has still continued, the pre-2008 figures of around 1.7 million have yet to be equalled.

Consumer spend

Total UK consumer expenditure increased between 2013-16 to £1216b (an increase of +8.0%). Expenditure for the whole furnishings, household goods and routine maintenance sector rose by +19.3% from 2013-16, reaching £58.8b, with a significant increase of +7.2% over the year from 2015-16. This expenditure increase exceeded that for all other competitor products.

Consumer expenditure on furniture and furnishings was almost £16.7b in 2016, and exceeded all other spend in the household goods sector. This represented a +24% increase from 2013. The YoY growth from 2013-15 was between 8 and 9%. However, growth from 2015-16 was somewhat less, at +5.5%.

The latest data shows that furniture and furnishings sales continued to rise into 2017, with first and second quarter consumer expenditures being respectively +5.9% and +5.4% higher than for the equivalent periods in 2016.

FURNITURE INDUSTRY TRENDS

Turnover

Total provisional UK furniture manufacturing turnover in 2016 was £8.35b, which was +4.5% higher than the previous year. Data up to and including September suggests that turnover in 2017 could be +3% greater than in 2016, although more recent anecdotal evidence points to more challenging market conditions in the last quarter.

Furniture manufacturing in 2013 equated to 1.35% of the UK’s total manufacturing turnover, whereas by 2016 this had increased to +1.60%. “Retail data suggests that furniture and furnishings demand at a consumer level has increased significantly, some of which will be derived from UK manufacturers,” says Pete. “It appears that our sector has done better than others YoY, so we are likely to gradually gain greater share of UK manufacturing turnover.”

In 2016, 6223 UK furniture manufacturers employed some 88,000 individuals. Despite its turnover being 1.60% of the total for UK manufacturing, the furniture sector employed 3.47% of all UK manufacturing personnel, which is estimated to have equated to 2.18% of the UK manufacturing wage bill.

Unlike the other subsectors, turnover for the office and shop contract sectors dropped between 2015-16 from £2.26b to £2.16b (-4.8%).

Turnover in the kitchen sector had historically fallen significantly from a high of £1.70b in 2008 to a low of £1.15b in 2011. Turnover increased, returning to £1.73b by 2014, but 2015 was a comparatively poor year, with turnover dropping back -£1.65b.

2016 data suggests that this was just a blip, with turnover increasing to £2.00b, which equated to a massive +17.8% increase on 2015. This increase was larger than might have been expected, and it is difficult to judge whether it was all attributable to the market, or whether it was partially due to data reconciliation issues.

The mattress subsector continued to grow. The £0.83b turnover in 2016 reflected a +9.1% increase on 2015.

The rest of furniture manufacturing comes under the heading of ‘other furniture’ in the digest, and comprises the largest of the industry’s four subsectors. In 2016, turnover in this subsector – which includes upholstery and cabinet furniture – reached £3.37b, which represented a +1.7% increase over the 2015 figure of £3.32b.

This broad subsector has a significant influence on UK furniture manufacturing’s overall performance figures, accounting for 40% of turnover. As such, any recovery in turnover here normally reflects the overall position for the whole furniture sector.

However, the increase for the whole sector from 2015-16 was much higher (at +4.5%), with the apparent large improvement in performance in the kitchen sector clearly influencing this overall increase.

Company size

Furniture manufacturing is dominated by micro- and small- to medium-sized businesses, with only 285 companies (4.6%) operating at turnovers in excess of £5m.

Just 140 companies turn over more than £10m. This number is slightly higher than the previous year, which indicates that some of the larger companies have continued to grow. “From a general business point of view, there is always a drive for companies to grow – either organically or by acquisition,” says Pete.

“However, the data also suggests that there were more companies in 2016 than in 2015 – so for every merger there has also been a number of new starts, predominantly at the lower turnover level.”

The latest data indicates 6230 companies in the sector, compared with 6155 in the previous year. Most of this growth has been in the number of companies turning over less than £1m, although there has been a slight increase in the number of organisations in the £2-5m bracket, which is assumed to be due to growth rather than new entrants.

The digest recorded that 82.6% of companies turned over less than £1m in 2016, and the largest percentage of companies are in the £100,000-250,000 turnover band (29.7%).

There is a significant proportion of extremely small companies within the whole furniture manufacturing sector, with 56.0% of organisations operating at turnovers of less than £250,000.

In the mattress and office and shop subsectors, the percentage of smaller companies is lower than for the other sectors (54.8% and 68.5% within these sectors, respectively, turn over less than £1m). Conversely, in the other furniture and kitchen sectors, this is higher, at 86.4% and 84.4% respectively.

The mattress sector has proportionately more large companies than the others. 19.4% of companies turn over more than £5m, compared with 10.5% for office and shop, and 3.1% each for the other furniture and kitchen sectors.

International trade

Imports of furniture into the UK in 2016 increased to £5.8b compared with the previous year’s figure of £5.4b. This equates to 42% of the home market for UK furniture manufacturing (including add-on services). Indications for 2017 are that furniture imports could reach £6.5b, which would equate to about 1% of all UK imports.

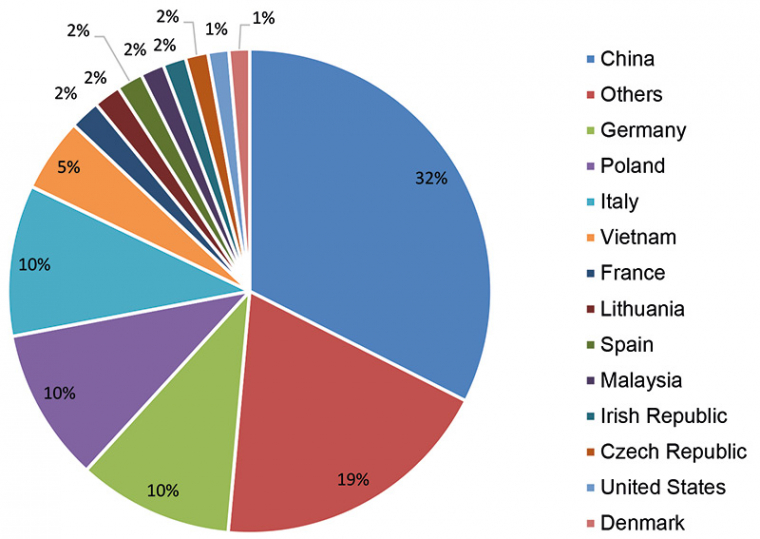

Furniture imports into the UK, 2016

The majority of imports originated from China (£1.9b), although its share of imports into the UK, having reached 33% in 2015, decreased slightly to 32% in 2016.

In pure financial terms, Italy lost its position of second in the hierarchy of furniture exporters to the UK, being overtaken by Germany and Poland, respectively. However, each of these countries roughly accounted for 10% of furniture imports into the UK, at about half a billion pounds each.

The value of 2016 imports from the European Community was £2.9b – an increase on the previous year when it was £2.6b.

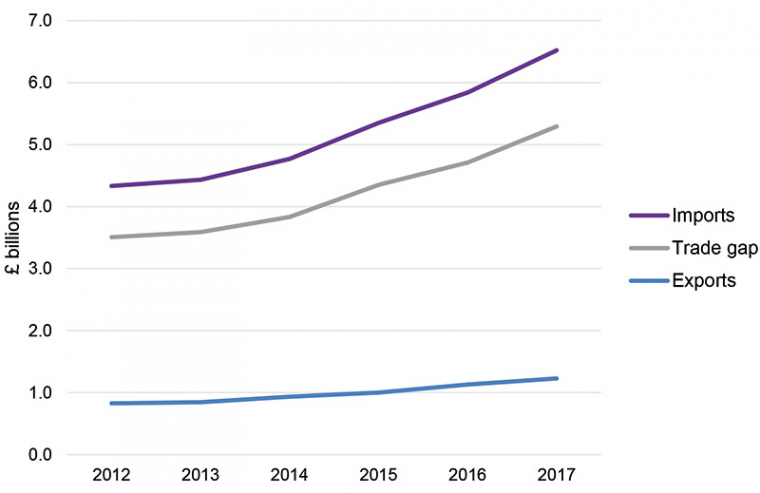

UK furniture trade figures, 2012 -17

Furniture exports have gradually increased in recent years, from £0.83b in 2012 to £1.13b in 2016. This equated to a +13% increase from 2015-16, which is a greater percentage increase than the +9% figure for imports over the same period. However, in pounds sterling, this increase of £0.13b in exports was somewhat smaller than the £0.48b increase in imports.

The prediction for 2017 is that exports will continue to increase and could reach £1.23b, which represents an improvement of +9% on 2016.

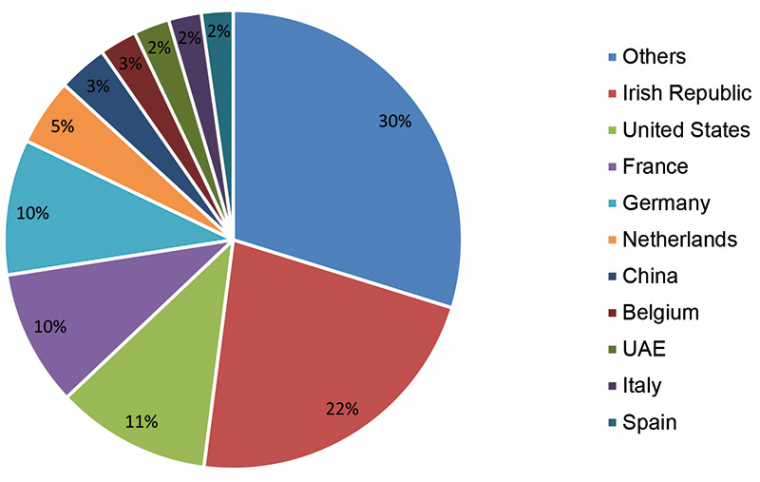

Exports to the Irish Republic have increased significantly over recent years. In 2016, it received 22% of all UK furniture exports, which equated to £0.25b.

There was a small increase in UK furniture exports to the US in 2016 (£0.12b), which accounted for 11% of the total. France and Germany, next in the hierarchy, each received 10% of UK furniture exports.

Trade with leading European nations continued to be the main source of export income (63% of the total) and the main trade destinations were similar to those in 2015. Exports to the European Community totalled £0.71b in 2016 – an increase of £0.08b – with France, Germany, The Netherlands, Belgium, Italy and Spain being the primary recipients.

The negative trade gap continued to widen, with increases in imports outstripping any small increases in exports. It reached £4.7b in 2016, and could be almost £5.3b by the end of 2017.

Furniture exports from the UK, 2016

Whilst exports to European countries are significant for the sector, the reality is that many of these countries continued to export more to the UK than vice versa. As such, the negative trade gap with the European Community in 2016 equated to £2.20b.

The main positive trade gap, as in previous years, was with the Irish Republic. This gap, despite the country’s recent increases in exports to the UK, moved from £0.14b in 2015 to £0.16b in 2016.

After this, there was a number of countries with which the UK benefited from much smaller positive trade gaps, starting with the US at £42m (almost double the previous year) and the UAE at £27m, also significantly greater than the previous year. Australia was next in the list, usurping Saudi Arabia, with the positive trade gap being £12m. The trade gap with Russia remained positive, but only by £11m.

All findings and summaries in this article are subject to copyright, being issued by FIRA International, the exclusive service provider to the Furniture Industry Research Association.

THE AUTHOR

Dr Peter Beele is the technical development manager at furniture testing and research body FIRA. The full report is available free to FIRA members, and for £2000 otherwise.