The order intake in the woodworking machinery sector has increased significantly in a double-digit range in the first quarter of 2021 compared to the previous year. As a result, the utilisation of machine capacities is also increasing.

Further growth can be expected in April, as the business situation in the mechanical engineering sector has picked up again and expectations remain at a high level. There are increasing signs that last year’s severe setback with a 14.5% drop in production can largely be made up for in the current year. In total, woodworking machinery worth €2.88bn (2019: €3.36bn) was produced last year.

“Already in the fourth quarter of the past year, the industry achieved the turnaround in orders across all segments. The figures now available for the first three months make us more than optimistic,” said Bernhard Dirr, managing director of the VDMA Woodworking Machinery Association at the Ligna.Outlook digital meet-up on 11th May. The VDMA expects a total production increase of 15% for the industry in 2021.

“With this, we are massively raising our forecast of plus 3% announced in November last year. We are more than optimistic about the coming months. However, there are also risks that we do not want to leave unmentioned. As of today, limited travel and the related hindrances in sales and assembly work continue to be the biggest risk.

In addition, the delivery times for component supplies have increased dramatically due to the global upswing in the mechanical engineering industry. This additional risk, as well as the internal hygiene measures still in force and the short-time work that partly exists in some areas, are still delaying production significantly in some cases,” Dirr explained.

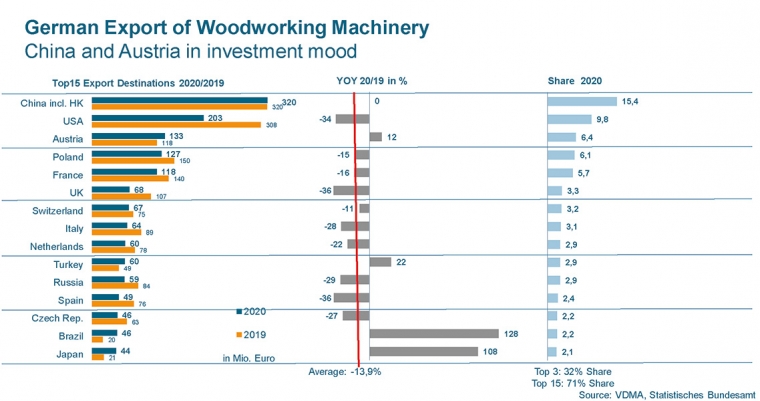

Growth is expected from all regions of the world. Besides China, which has already picked up considerable momentum in the corona year 2020, the industry sees the greatest growth potential in North America. But in Europe, too, there are substantial growth opportunities in all customer segments from carpentry and joinery to industry.

According to the VDMA’s figures for 2019 to 2020, the UK market fell year-on-year from €107m in 2019 to €68 in 2020 – a fall of by 36%. Over the same period, the USA dropped away by 34% to €203m. Notably, exports to Brazil and Japan rose 128% (€46m) and 108% (€44m) respectively.