The decoration of wood-based panels with a variety of surfacing materials is a key value-adding step in the value chain. As the global demand for wood-based panels grows, mainly at the expense of solid wood and veneer-based products, surfacing materials benefit.

Among the findings from Pöyry Management Consulting’s latest report for this sector, Panel Surfacing up to 2020, perhaps predicatably, China’s position as the world’s largest consumer of surfacing materials remains unchanged.

Across the world, over 70% of surfaced wood-based panels are used for furniture, while the remaining 30% are construction-related products, including flooring and doors. Many consumers prefer lightweight, ready-to-assemble and low-maintenance furniture at affordable prices and the analysed surfacing materials for wood-based panels meet these requirements much better than materials for traditional furniture.

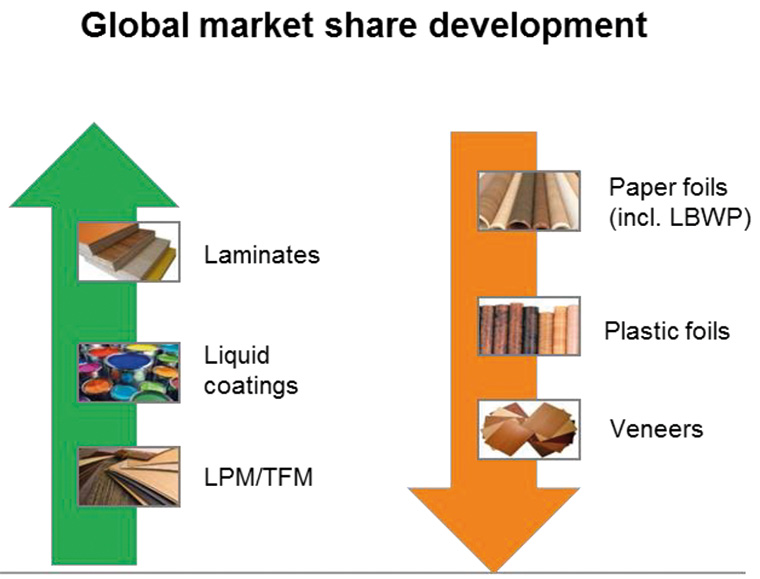

The 2010-2015 period was excellent for surfacing materials demand growth. The post-great recession demand recovery drove the global market to an all-time high of 6.6% growth per annum. Out of the six main surfacing materials the two clear winners were low pressure melamine (LPM/TFL) and laminates, while wood veneer experienced a 5% market share loss.

When comparing the regional performance, Asia’s double digit growth resulted in an 11% market share gain, translating into 59% share of the total global surfacing materials demand.

Looking ahead to 2020, HPL and CLP laminates are predicted to experience the highest relative growth, however in absolute volume terms low pressure melamine is set to remain the dominant material, accounting for over 60% of the global demand.

The only material with negative future growth (minus 0.5% per annum) is veneer. Its performance, cost and sourcing issues are being constantly challenged by its main rival, low pressure melamine. Veneer is going to be relegated from the second most used material to fifth place by 2020, while all other materials are forecast to grow between 2-4% per annum.

Overall, future surfacing materials market growth is going to slow down to some 3% per annum in the most likely (central) scenario.

“Growth started from a low base after the global financial crisis,” explains Johan Carlsson, principal at Pöyry Management Consulting. “Additionally, China is expected to accelerate transition from manufacturing to a consumption and service-driven economy. At the same time, there is little hope for significant growth from other BRIC countries as the recession in Brazil and slow recovery result in marginal demand growth in South America.

“Demand in Russia will remain at current levels with the potential for further falls in the short term if oil prices do not improve. Last but not least, the Eurozone debt crisis and Brexit uncertainty continue to hamper market growth in Europe.”

There has been significant investment in wood-based panel production capacity in South east Asia to meet growing demand. However, wood fibre scarcity in this region continues to increase and is likely to be a game changer, albeit in the long term.

By 2020 it is not likely that China’s position as the world’s largest consumer of surfacing materials, accounting for over 50% of the global demand, and the number one furniture producer in the world, will change.

Recent merger and acquisition activity has significant long term potential to change the industry structure on a regional or even global scale.

European wood-based panel producer Kronospan has entered North America, bringing with it forward integrated business models and investment in modern equipment. South American wood-based panel producer Arauco has entered North America and Europe through acquisitions and joint ventures, while consolidation among liquid coating producers has created two global giants – AkzoNobel and Sherwin-Williams.

In the recent years the level of innovation and new product development has been remarkably high. While cost reduction is a constant, innovation is mainly driven by the need for improved performance (functionality and/or design) or, to a much lesser extent, by sustainability. More recently there has been the first signs of circular economy principles being adopted.

New materials and decorative techniques are clamouring for attention and bring new unique selling points. Powder coatings, direct printing and other new innovative surfacing materials continue to gain market share at the expense of traditional materials, albeit from a very small base.

While the total estimated size of the global market for new surfacing materials is currently some 2%, they are set to make further inroads.

These are some of the findings of Pöyry’s Panel Surfacing up to 2020 report. In this forward-looking assessment Pöyry addresses global macroeconomic environment trends to create three future demand scenarios as well as providing expert industry insights.

Images courtesy of Pöyry